7 Types of Folks Who Might Consider the AMEX SimplyCash Plus Card

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Looking for a good credit card for your small business?

If you own a small tech company, have vacation rentals, are a general contractor, a sales professional (like insurance or real estate), or an Amazon & eBay reseller, the SimplyCash® Plus Business Credit Card from American Express could be a great option!

I’ll explain why this is a useful card for folks who like the simplicity of cash back. And how you can do really well with the bonus categories, extended warranty protection, and control over your employees’ cards.

Earn Bonus Cash Back With the AMEX SimplyCash Plus

Link: AMEX SimplyCash Plus Small Business Card

Link: How to Fill Out an AMEX Business Credit Card Application

To start, you must have a small business to apply for the AMEX SimplyCash Plus card. But you don’t need millions in revenue!

You can use your social security number to apply as a sole proprietor. If you’re trying to turn a profit with your venture, your small business will likely qualify. Because using the card can help you grow the company.

The AMEX SimplyCash Plus small business card is offering a limited-time $250 sign-up bonus (in the form of a statement credit) when you spend $5,000 on purchases in the first 6 months of opening your account.

Along with perks like:

- 5% cash back at office supply stores in the US and on your US wireless phone bill (up to $50,000 in purchases per calendar year)

- 3% cash back on eligible purchases (up to $50,000 in purchases per calendar year) in 1 of 8 categories of your choice (like computer hardware & software and US gas stations)

- 1% cash back on everything else

- The ability to “buy above your credit limit”

- 2.7% foreign transaction fee after conversion to US dollars

- No annual fee

- Terms and limitations apply

You can choose one 3% cash back category from this list:

- Airfare purchased directly from airlines

- Hotel stays purchased directly from the hotel

- Purchases made directly from the car rental companies listed here. (Includes Alamo, Avis, Budget, Dollar, Enterprise, Hertz, National, Payless, Thrifty, etc.)

- Purchases at US gas stations

- Purchases at US restaurants

- US purchases for shipping

- US purchases for advertising in select media. (This includes placing ads on Google & Facebook)

- U.S. computer hardware, software and cloud computing purchases made directly from select providers

Some folks might be targeted for an even better sign-up bonus. So check your email and postal mail!

This card is NOT the best card for everyone. But folks with these types of business might like to take a closer look.

Consider the AMEX SimplyCash Plus Card If You Own These Types of Small Businesses

1. Small Tech Company

If you own a small tech start-up, are a graphic or web designer, or operate any type of business where you buy a lot of computer hardware & software, consider this card!

Because you can choose to earn 3% back on computer hardware & software, on up to $50,000 in purchases each calendar year. For a total of up to $1,500 cash back (3% X $50,000)!

And AMEX cards are worth using for certain types of computer hardware, because they offer great extended warranty coverage.

2. General Contractor

Are you Mr. or Mrs. Fix-It? This card is great for general contractors because it gives you the ability to buy above your credit limit.

So if you need to buy an expensive piece of equipment, like an excavator or trailer, you may be able to use your AMEX SimplyCash Plus card for the purchase, and earn cash back too! Even if the price exceeds your credit limit.

3. Vacation Rental Owners

Do you have an Airbnb? Think about getting this card, because you’ll earn 5% back at US office supply stores. When they go on sale, you can stock-up on things like paper towels, toilet paper, and coffee for your guests.

That said, if you prefer to buy these items at wholesale clubs, you might do better with the Bank of America® Cash Rewards credit card, which earns 2% back at stores like Costco, Sam’s Club, and BJ’s.

Or use the Chase Freedom, which earns 5X Chase Ultimate Rewards points (5% cash back) at wholesale clubs through December 31, 2016. But remember to activate the bonus!

4. Consultants, Photographers, Sales Professionals, and Others Who Travel for Work

Folks in sales can spend a lot of time on the phone and driving to meet clients. So if you’re a sales professional, like a real estate or insurance agent you could save money with the card.

Because you’ll earn 5% cash back on US cell phone bills (on up to $50,000 per calendar year) and can choose to earn 3% back at US gas stations or on travel expenses like airline tickets or rental cars.

For example, if you own a photography business and shoot wedding or destination photos, the AMEX SimplyCash Plus card could work well for you.

Because you can earn 3% cash back on 1 of the categories you’re probably already spending money on.

You can even get cash back for purchasing photo editing software!

That said, the Chase Ink Business Cash Credit Card is an alternative if you spend a lot in these categories. Because you’ll

Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on cellular phone, landline, internet and cable TV services each account anniversary year. Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other card purchases with no limit to the amount you can earn.

Here’s my review of the Chase Ink Cash.

5. Amazon & eBay Resellers

The AMEX SimplyCash Plus card is a good option for Amazon & eBay resellers, because you can earn 5% cash back at US office supply stores on purchases like boxes, tape, and labels.

And you can earn 3% cash back on shipping services too with places like UPS, FedEx, and USPS.

6. Folks Who Spend Money on Online Advertising

Real estate agents, attorneys, dentists, or anyone who advertises online should consider the AMEX SimplyCash Plus.

If you choose US advertising in select media as your 3% cash back category, you’ll earn bonus cash back for online ads like Facebook, Google Ads, and Yahoo.

And you’ll earn 5% back at office supply stores when you stock up on items for your office!

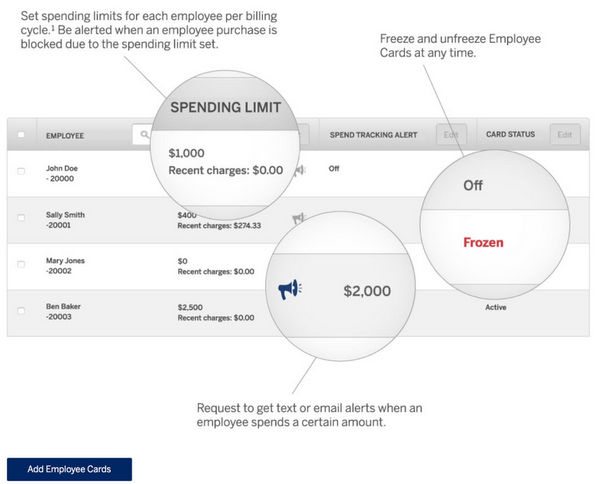

7. Owners Who Want Control Over Employee Spending While Earning Cash Back

If you have a team of employees, and want to earn cash back on their business spending (but stay in control!), the AMEX SimplyCash Plus is a good choice.

You can easily add employee cards online. And you can set spending limits, freeze and unfreeze cards at any time, and track employee purchases.

And you’ll earn cash back for the entire team’s purchases!

Other Perks of the AMEX SimplyCash Plus Small Business Card

Because you don’t have to register for rotating bonus categories, the AMEX SimplyCash Plus card is great for folks looking for simplicity. You pick your 3% cash back category and you’re done.

Also, AMEX small business cards do NOT hamper your ability to get Chase cards. So you don’t have to worry about Chase’s stricter approval rules.

And don’t forget, American Express now unofficially allows you to have 5 AMEX credit cards too!

Bottom Line

The AMEX SimplyCash Plus card is a great no-annual-fee cash back option for small business owners.

Especially small tech companies, general contractors, Airbnb owners, real estate agents, sales professionals, and Amazon & eBay resellers.

It’s terrific for folks who spend a lot in the cash back bonus categories. Or who want to make big purchases to grow their small business.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!