How to Earn Big Travel With AMEX Charge Cards!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Certain American Express charge cards have terrific welcome bonuses and spending category bonuses which can quickly get you Big Travel with Small Money!

Most major banks issue credit cards, which allow you to carry a balance (not that you should!) as long as you make a minimum payment each month.

But some lenders, like American Express, also offer charge cards. These cards have no pre-set spending limit, but you have to pay the balance in full each month.

And because charge cards do NOT count toward American Express’ 4 credit card per person limit, you can safely apply for them even if you have lots of other AMEX cards!

What’s the Deal?

Link: What’s the Difference Between a Charge Card and a Credit Card?

Link: How Many AMEX Cards Can You Have at 1 Time?

American Express offers a number of charge cards which earn AMEX Membership Rewards points.

These points can be used for travel such as a First Class flight on Singapore Airlines to Europe, flights on Hawaiian airlines, and stays in Hilton hotels that include Conrad and Waldorf Astoria.

American Express Membership Rewards points are very flexible! You can transfer them to over a dozen airlines and hotels, usually at a 1:1 ratio.

| American Express Membership Rewards Airline Transfer Partners | ||

|---|---|---|

| AeroMexico | Air Canada | Alitalia |

| ANA | Asia Miles | British Airways |

| Delta | El Al | Emirates |

| Etihad | Flying Blue (Air France / KLM) | Hawaiian Airlines |

| Iberia | JetBlue | Singapore Airlines |

| Virgin Atlantic |

| American Express Membership Rewards Hotel Transfer Partners | ||

|---|---|---|

| Choice | Hilton | Starwood |

There’s no limit to the number of American Express charge cards you can have open.

Having multiple American Express cards can earn you more discounts! For example:

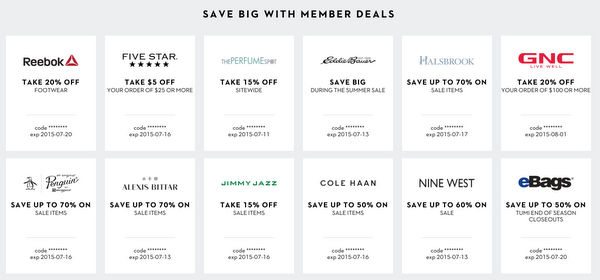

AMEX Offers – Having multiple AMEX cards gives you more opportunity to be targeted for these discounts. And you can get the same offer on more than 1 card! AMEX OPEN – (business cards only) – Earn automatic discounts when you use your AMEX business card at participating merchants, like FedEx and Hertz. Small Business Saturday – Hopefully Small Business Saturday will return this year! Having another AMEX card will get you more discounts! ShopRunner – Get free membership in ShopRunner (free shipping & discounts from dozens of online merchants) by having an AMEX card.

Keep in mind, even though AMEX doesn’t impose a pre-set spending limit on charge cards, it doesn’t mean you can whip out a card and buy a yacht! It’s up to AMEX what they’ll approve.

And remember, you’re still limited to 1 welcome bonus per person, per lifetime on American Express personal cards. With business cards, you can earn the bonus again if you haven’t held the card in the past 12 months.

Let’s see what the current offers are for American Express’ charge cards.

1. The Business Gold Rewards Card from American Express OPEN

Link: The Business Gold Rewards Card from American Express OPEN

The Business Gold Rewards Card from American Express OPEN has a welcome bonus of 25,000 American Express Membership Rewards points after you spend $5,000 on purchases in the 1st 3 months of opening your account.I like this card because you earn 3 AMEX Membership Rewards points per $1 you spend on ONE of the following categories (your choice):

- Flights purchased directly from airlines

- US advertising in select media such as online, TV, radio

- Shipping purchased in the US

- US gas stations

- Buying directly from US locations of certain computer hardware, software, and cloud computing stores

And you’ll earn 2X AMEX Membership Rewards points per $1 you spend in the remaining 4 categories.

The $175 annual fee on this card is currently waived for the 1st year.

And 25,000 AMEX Membership Rewards points are enough for a domestic round-trip coach ticket on airline partners like Delta or Air Canada! Not a bad deal for applying for 1 card!

Remember, this is a small business card, so you’ll get access to American Express OPEN discounts.

You do NOT need millions in sales to qualify! AMEX makes the final decision, but examples of folks with small businesses that could be approved are freelance writers and designers, dentists, real estate agents, and those starting a new venture.

It’s OK to apply with your social security number if you’re a sole proprietor.

2. American Express Premier Rewards Gold

Link: American Express Premier Rewards Gold

Link: My Review of the Changes to the American Express Premier Rewards Gold

American Express recently made changes to the American Express Premier Rewards Gold card, including removing foreign transaction fees, adding a $100 annual airline fee credit, and including restaurants as a bonus spending category.

With this card, you’ll earn 25,000 American Express Membership Rewards points after you spend $2,000 on purchases in the 1st 3 months of opening your account.

And you’ll get:

- 3 points per $1 you spend on airfare purchased directly from airlines

- 2 points per $1 you spend at US gas stations, US supermarkets, and US restaurants

- 1 point per $1 you spend on everything else

- $100 per calendar year in airline incidental fee credits (baggage fees, change fees, etc.)

- NO foreign transaction fees

- Transfer points to participating frequent traveler programs

- Annual fee of $195, currently waived for the 1st year

- Terms and limitations apply

The $100 airline incidental fee credit offsets about half of the annual fee. And folks who travel overseas can use this card without being charged foreign transaction fees.

Note: The 2X bonus spending categories (gas stations, supermarkets, and restaurants) are only for US purchases.You could transfer 25,000 American Express Membership Rewards points to Flying Blue (Air France and KLM’s frequent flyer program) for a discounted Flying Blue Promo Award ticket to Europe!

3. The Platinum Card From American Express

Link: The Platinum Card From American Express

Link: My Review of The Platinum Card From American Express

In the past, folks have received targeted offers for the American Express Platinum Card as high as 100,000 American Express Membership Rewards points after meeting (sometimes high) minimum spending requirements.

The current welcome bonus for this card is 40,000 American Express Membership Rewards points after you spend $3,000 on purchases in the 1st 3 months of opening your account.

You’ll also get:

- Up to a $200 Qualifying Airline Fee Credit Annually (to receive the statement credit, you need to select a qualifying airline)

- Airport lounge access (Delta, Priority Pass, Airspace, and American Express Centurion Lounges)

- NO foreign transaction fees

- $100 statement credit for Global Entry or TSA PreCheck

- $450 Annual Fee NOT Waived

- Terms & limitations apply

While the $450 annual fee (not waived for the 1st year) is substantial, if you use your $200 airline fee credit, your net cost is only $250 ($450 annual fee – $200 annual airline fee credit).

And folks who can use the lounge access frequently can get a great value from this card!

Note: You’ll pay a 0.06 cent per point excise fee when you transfer American Express Membership Rewards points to US airlines, up to a maximum of $99.4. American Express Mercedes-Benz Platinum

Link: The Platinum Card® from American Express Exclusively for Mercedes-Benz

Link: My Review of the American Express Mercedes-Benz Platinum

The American Express Mercedes-Benz Platinum card has a higher welcome bonus than the regular American Express Platinum card.

You’ll earn 50,000 American Express Membership Rewards points after you spend $3,000 on purchases in the 1st 3 months of opening your account.

Combined with the points you’ll earn from meeting the minimum spending requirement, the welcome bonus is almost enough for a 1-way First Class ticket on airline partner Singapore Airlines. In an amazing suite!

But the annual fee is higher. You’ll pay $475 (not waived for the 1st year). That said, I’d gladly pay an extra $25 for an additional 10,000 AMEX Membership Rewards points!

This cards perks are almost identical to the American Express Platinum. But in addition, you’ll get:

- A $1,000 certificate each year you spend $5,000 or more on the card toward the purchase or lease of a new Mercedes-Benz

- $100 certificate when you renew your account each year, good towards Mercedes-Benz accessories

- Up to 2,000 excess miles waived when you return your leased Mercedes-Benz

So this is a good deal not only for folks who love to travel, but for those who like to drive in style! 🙂

For myself, I don’t need a fancy car. But if I were to choose expensive German engineering, I was very impressed with the blazing speed safety & handling of the Audi I drove with Silvercar!

5. The Business Platinum Card From American Express OPEN

Link: The Business Platinum Card From American Express OPEN

Link: My Review of the Business Platinum Card From American Express OPEN

You’ll earn 40,000 American Express Membership Rewards points when you apply for the American Express Business Platinum card and spend $5,000 on purchases in the 1st 3 months of opening your account.

That’s a great deal, but keep in mind they’ve increased the bonus in the past to as high as 150,000 American Express Membership Rewards points after meeting minimum spending requirements.

Like the personal version of the AMEX Platinum card, you’ll also get:

- Up to $200 in airline fee credit per calendar year on select airlines (you have to enroll and select a qualifying airline each year)

- Access to airport lounges (Delta, Priority Pass, Airspace, and American Express Centurion Lounges)

- NO foreign transaction fees

- $85 TSA PreCheck or $100 Global Entry statement credit

- Terms and limitations apply

Again, this is a small business card. Many folks qualify for business cards even if they have a side or new business, like buying and selling goods online, providing paid child care for others, or being paid to blog.

Bottom Line

Don’t forget that American Express charge cards, like the American Express Platinum or Premier Rewards Gold cards, are great options to earn points for Big Travel.

You can use American Express Membership Rewards points you’ll earn to fly in a lie-flat Business Class seat, take trips with your family, or treat your loved ones to an amazing hotel suite they’d otherwise never experience.

With charge cards, you must pay your balance in full every month (and you should anyway!). And AMEX doesn’t set a pre-set limit on what you can spend (but they’ll decide whether to approve your purchases based on your income and credit history).

Even better, AMEX charge cards do NOT count toward the 4 credit card limit folks are allowed. So you can earn even more discounts and perks from AMEX Offers, Small Business Saturday, and more.

Which American Express charge card is your favorite for Big Travel?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!