Save Money Using Citi Price Rewind to Track Your Purchases

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Did you know you can get money back if you buy an item with your Citi credit card and the price later drops?

The Citi Price Rewind program refunds you money when prices go down on certain items you’ve bought!

I’ll explain how this perk works and how to use it. And which cards are included!

About the Citi Price Rewind Program

Link: Citi Price Rewind

Link: Citi Price Rewind Guide

Link: How Citi Price Rewind Works

Citi’s Price Rewind program will refund your money automatically if something you’ve bought with your Citi credit card goes down in price.

There are a few limitations, but it’s easy to use. And you could do well if you think something you want to buy will go on sale soon!

Which Citi Cards Are Eligible?

All personal credit cards issued by Citi are included in the Citi Price Rewind Program.

But business cards, debit cards, and any cards not issued by Citi are NOT eligible.

How It Works

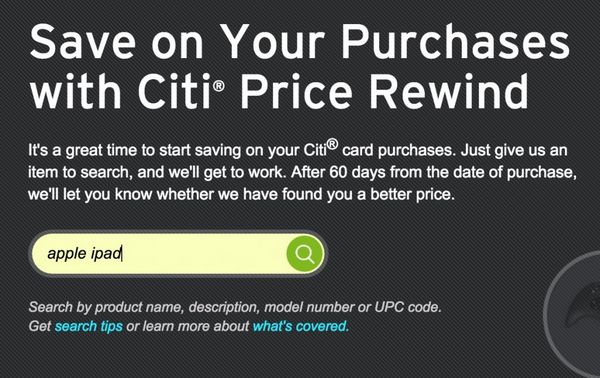

Step 1 – Sign-In to Citi Price Rewind and Search

Use your Citi username and password to sign-in to the Citi Price Rewind website, and search for the item you bought.

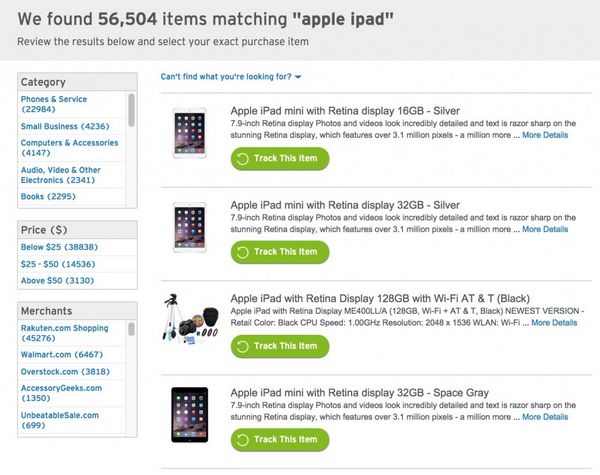

Step 2 – Find the Item You Purchased

You’ll see a list of items that match your search. Choose the exact product you purchased.

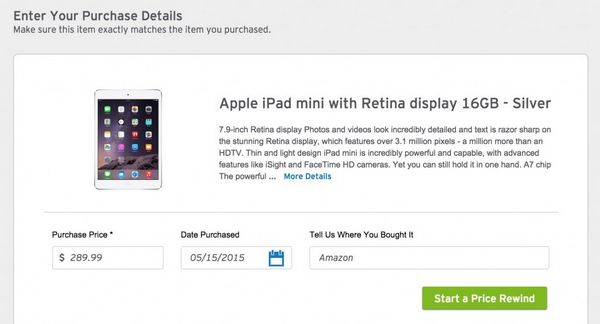

Step 3 – Enter Your Purchase Details

Fill in the purchase date, price, and where you bought the item.

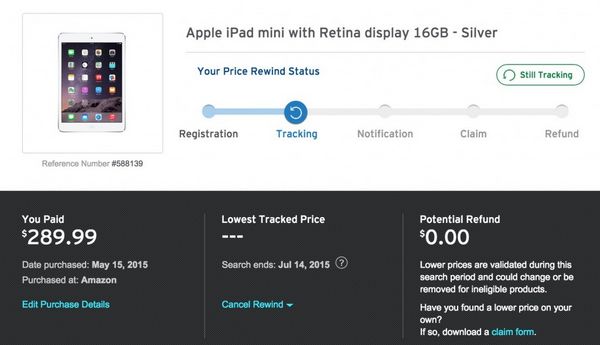

Step 4 – Citi Will Track Your Purchase for 60 Days

For 60 days, Citi will watch the item for price changes. If the price drops, you will be refunded the difference!

For price drops under $25, you’ll get a statement credit. But if it’s more than $25, Citi will email you. Then you can choose between a statement credit or a paper check.

What’s Included and What’s NOT

To be eligible for a claim, the item you want to track must be bought new and for full-price. And you must pay for the whole cost of the item with your Citi card.

A few things that ARE included:

- Appliances

- Clothing

- Electronics

- Furniture

- Toys

These are all great categories where you can save money!

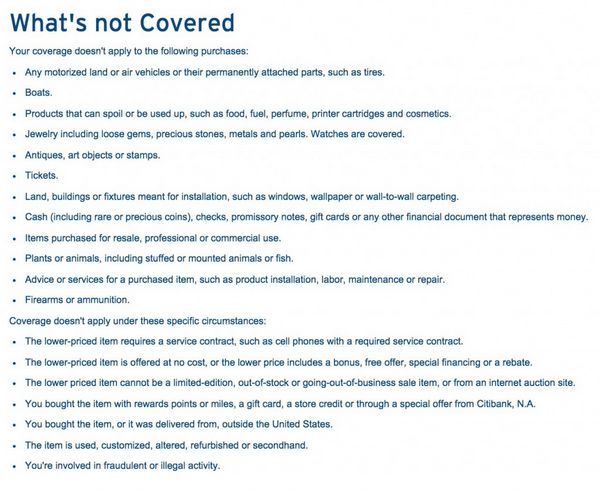

Perishables, boats, vehicles, tickets to events, airfare, live animals, firearms, and antiques are NOT included in Citi Price Rewind. Hotel rooms are NOT included, either. Here is the full list:

Are There Limitations?

While Citi will track your item for you at hundreds of merchants, you can also submit a manual claim for the price difference. However, you must submit your claim within 180 days of purchase.

The claim form is here. Citi says:

To submit a manual claim you will need to provide the advertisement containing the lower price for your item, and a copy of the itemized receipt for the item purchased that was made entirely with your Citi credit card.

The advertisement of the lower price must have been published or made available within 60 calendar days after your purchase date and must be for the same item by the same manufacturer for a lower price.

The program is limited to $300 per item and $1,200 per calendar year. The easiest way to make the most of this benefit is to register the items you want to track on the Citi Price Rewind website.

With Citi Price Rewind, you could more than make up for the annual fee on cards like the Citi Prestige, Citi ThankYou Premier, and Citi Executive AAdvantage card!

Who Should Use It – And When

Folks who have personal Citi credit cards and think that an item will go down in price within 60 days should use this benefit.

It is free to register an item on the Citi Price Rewind website. And it only takes a couple of minutes. It’s especially helpful if you think an item will go down in price. And if you’re not sure, register your item anyway. You might get some extra money that you weren’t expecting!

Items that are a good idea to register include:

- Electronics that are due for a product update

- Clothes that are purchased between seasons

- Any item might have a price drop due to consumer demand or increased competition in the marketplace

Also remember that lots of full-price items go on sale around Black Friday each year. It might be worth it to do your holiday shopping with a Citi credit card. And then register all your items before they go on sale!

Track Price Drops – Even Without a Citi Credit Card

There are 2 programs that can help you even if you don’t have a Citi credit card. But both programs are even better if you do!

1. CamelCamelCamel

CamelCamelCamel is a website that tracks price changes on Amazon products. It is free to sign-up.

It tracks the historic prices of products on Amazon, and lets you know the best times to buy certain items. That way you won’t max out your Citi Price Rewind as quickly!

And you can double-check this website to make sure Citi Price Rewind is pulling in the same information.

2. Paribus

Paribus can save you money, too. It’s free to sign-up.

It links to your email account and automatically tracks your purchases, much like Citi Price Rewind. If there is a price change on a product, they will submit a price adjustment claim on your behalf. Many popular merchants are included like Amazon.com, Gap, Staples, and many more.

Paribus keeps 25% of the money they reclaim, and credits the rest back to the card you have on file.

And it works with ANY credit or debit card, not just Citi cards! So this is a trick that anyone can use to save money!

Bottom Line

Citi Price Rewind is a great built-in feature of all Citi personal credit cards. By registering your Citi card purchases, Citi Price Rewind will track items for price drops for 60 days and credit you the difference.

You’ll be reimbursed up to $300 per item and $1,200 per calendar year.

You can use CamelCamelCamel and Paribus to help you further maximize the Citi Price Rewind program!

Citi Price Rewind could be a money-saver for items that might go on sale. And for holiday shopping at the end of the year!

Any money you are refunded from Price Rewind is a great way to offset the annual fee from any Citi credit card!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!