Why You Should Apply for Cards From Different Banks

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. This page includes information about the Discover it® Cash Back that is not currently available on Million Mile Secrets and may be out of date.Million Mile Secrets reader Chris commented:

Do you have a list of the different bank credit cards and what credit reporting company they use? This would help in deciding what credit card to open next.

Unfortunately for Chris, there isn’t a simple answer of which credit reporting agencies are used by the banks. That’s because banks may use a different reporting agency depending on your state.

But I’ll give you some tips!

Applying for Credit Cards

Link: The 5 Dangers of Applying for Credit Cards

Link: Does Applying for Credit Cards Ruin Your Credit Score

Link: How your FICO score is calculated

Chris can earn lots of miles and points by applying for credit cards. But before he does, he should know the 5 dangers of applying for credit cards and the impact it can have on his credit score.

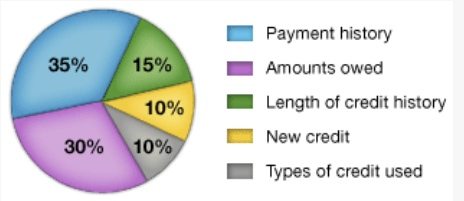

According to the FICO website, Chris’ credit score is calculated by:

- 35% payment history

- 30% amounts owed

- 15% length of credit history

- 10% new credit

- 10% types of credit

Chris can get his credit report for free from AnnualCreditReport.com, Credit Sesame, and CreditKarma.

And he can get his free FICO score if he has a card issued by:

Barclaycard – TransUnion FICO scores- Citi – Equifax FICO scores

- Discover – TransUnion FICO scores

Timing Applications

When Chris applies for a credit card, the bank pulls his credit score which temporarily lowers his credit score a few points. But, after 3 to 6 months, Chris’ score will bounce back. However, the credit inquiry stays on his credit report for 2 years.

So Chris should consider the timing of his credit card applications.

Some folks apply for cards every 90 days while others wait to cherry-pick big sign-up bonuses. Waiting every 90 days gives Chris’ credit score time to rebound.

However, folks who wait for big bonus offers don’t have to worry too much about a lowered credit score because it may have been months since their last application.

Why You Should Apply for Cards From Different Banks

Link: 5 Free Ways to Find Out Which Credit Bureau Banks Use & Why It Matters

Chris should apply for cards from different banks because the banks don’t like it if he has 12 to 16 inquiries per credit bureau. So applying for cards from different banks helps to spread his credit pulls over all 3 credit bureaus.

However, there isn’t an exact science to which credit bureaus the banks use because it can vary depending on where Chris lives and the credit card.

Folks who you apply for less than ~5 credit cards a year, may not have to worry about this as much.

Note: Capital One pulls from all 3 bureaus!

There’s a data base where people contribute information about their applications. You can search by issuing bank (such as American Express) and your state.

Which Banks Use Which Credit Bureau

It’s hard to find complete information about which bureaus the banks pull from, but here’s what I’ve found:

Note: I put this together for your convenience. But it is NOT a comprehensive list!1. American Express

A. American Express Premier Rewards Gold

Link: Premier Rewards Gold Card from American Express

- Experian (California and New York)

B. American Express Platinum

Link: The Platinum Card from American Express

Link: The Business Platinum Card from American Express

- Experian (California, Illinois, and New York)

- TransUnion (Illinois)

C. Gold Delta SkyMiles

Link: Gold Delta SkyMiles

- Experian (Illinois and New York)

- TransUnion (California)

D. Starwood Preferred Guest

Link: Starwood Preferred Guest® Credit Card from American Express

Link: Starwood Preferred Guest® Business Credit Card from American Express

- Equifax (Illinois)

- Experian (California, Illinois, and New York)

- TransUnion (California)

2. Barclaycard

Barclaycard Arrival Plus

Link: Barclaycard Arrival Plus

TransUnion (California, Illinois, and New York)

3. Chase

A. British Airways

Link: British Airways

- Equifax (California)

- Experian (California and New York)

- TransUnion (New York)

B. Freedom

Link: Freedom

- Equifax (California, Illinois, and New York)

- Experian (California, Illinois, and New York)

- TransUnion (California and New York)

C. Sapphire Preferred

Link: Sapphire Preferred

- Equifax (California)

- Experian (California)

- TransUnion (Illinois and New York)

D. United MileagePlus Explorer

Link: United MileagePlus Explorer Card

- Equifax (California)

- Experian (Illinois and New York)

- TransUnion (California and Illinois)

4. Citi

A. Citi AAdvantage

Link: Citi® / AAdvantage® Platinum Select® World Elite™ Mastercard®

- Equifax (California, Illinois, and New York)

- Experian (California and Illinois)

B. Citi Hilton HHonors Reserve

Link: Citi Hilton HHonors Reserve Card

- Equifax (California)

C. Citi ThankYou Preferred

Link: Citi ThankYou Preferred Card

- Equifax (Illinois)

- Experian (California)

- TransUnion (New York)

D. Citi ThankYou Premier

Link: Citi ThankYou Premier Card

- Equifax (Illinois)

- Experian (New York)

Remember, to get more specific information, Chris can use resources like CreditBoards.com to find out which banks use which credit bureau.

So Which Card Should Chris Open Next?

It depends on Chris’ travel goals!

Choose cards that can get you the Big Travel you want. Then just watch that you don’t apply for too many cards from the same bank at once.

Each bank makes their approval decisions differently. But in general, you’ll do well when you establish a good relationship with each bank.

You can do that by paying your bills on time and using the cards (even after you get the sign-up bonus)! And it doesn’t hurt to have a checking account or years of history with the issuer.

Bottom Line

Banks use different credit bureaus depending on the card Chris applies for and where he lives.

So Chris should apply for cards from different banks to help limit the number of inquiries to each credit bureau and the impact on his credit score.

Chris can get a free credit report from AnnualCreditReport.com, CreditKarma, and Credit Sesame.

He can also get his score for free if he has a Citi, or Discover card.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!