Which Barclaycard AAdvantage Aviator Card Should You Get?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: This offer is no longer available. Check our Hot Deals for the latest offers.Folks are getting offers from Barclaycard to upgrade their current US Airways card to the new Barclaycard AAdvantage Aviator Silver card.

I’ve written before that the US Airways card will become an American Airlines card. Barclaycard has just released details about their American Airlines cards: AAdvantage Aviator Silver and AAdvantage Aviator Red.

Barclaycard AAdvantage Aviator Silver Card

All US Airways cards will become a Barclaycard AAdvantage card. And you can’t apply for these new Barclaycards. But some folks are receiving offers to upgrade their US Airways card to the Barclaycard AAdvantage Aviator Silver card, instead of the standard Aviator Red.

With the AAdvantage Aviator Silver card, you get:

- 1st checked bag free for you and up to 8 traveling companions

- Priority boarding

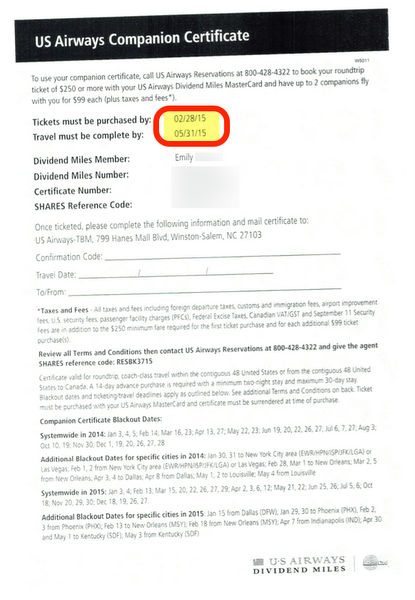

- $99 companion certificate for up to 2 guests after spending $30,000 by account anniversary

- 3X American Airlines miles on American Airlines & US Airways purchases

- 2X American Airlines miles on hotels and car rentals

- 1X on everything else

- 10% of redeemed miles back (up to 10,000 miles per year)

- 5,000 elite qualifying miles for every $20,000 spent each year (up to 10,000 elite qualifying miles)

- 25% discount on in-flight purchases

- No foreign transaction fees

The $195 annual fee is NOT waived the 1st year.

If you received the upgrade offer, you have to upgrade by December 1, 2014.

Your card will be upgraded after your January 2015 statement closes. You’ll receive your new card after American Airlines and US Airways merge.

For most folks, the $195 annual fee isn’t worth upgrading to the Silver card. The $99 companion certificate is hardly a good value, because you have to spend a LOT ($30,000) to get it.

But the AAdvantage Aviator Silver card is a good choice for folks who:

- Are Big Spenders

- Buy American Airlines and US Airways tickets (Because you’ll earn 3X American Airlines miles per $1 spent)

- Have elite status with American Airlines

- Travel with up to 8 companions

- Travel internationally (Because there is no foreign transaction fee)

Barclaycard AAdvantage Aviator Red Card

Most folks will get the AAdvantage Aviator Red card because it has a lower fee. That said, there is no sign-up bonus on the card. But getting 10% of your miles back (up to 10,000 miles per year) could be worth the cost of the annual fee.

The AAdvantage Aviator Red card gets you:

- 1st checked bag free for you and up to 4 traveling companions

- Priority boarding

- $100 flight discount after spending $30,000 in a calendar year

- 2X American Airlines miles on American Airlines & US Airways purchases

- 1X American Airlines miles on everything else

- 10% of redeemed miles back (up to 10,000 miles per year)

- 25% discount on in-flight purchases

The $89 annual fee is NOT waived the 1st year.

Comparing the AAdvantage Aviator Silver & AAdvantage Aviator Red Cards

Here’s a table comparing the perks of the AAdvantage Aviator Silver and AAdvantage Aviator Red cards:

| Card features | AAdvantage Aviator Silver | AAdvantage Aviator Red |

|---|---|---|

| Miles earned on American Airlines & US Airways purchases | 3X | 2X |

| Miles earned on hotels & car rentals | 2X | 1X |

| Miles earned on all other purchases | 1X | 1X |

| Earn 5,000 elite qualifying miles for each $20,000 in annual purchases (up to 10,000 elite qualifying miles per year) | X | |

| $99 Companion certificate for up to 2 guests with $30,000 in purchases by account anniversary | X | |

| $100 flight discount each year with $30,000 in annual purchases | X | |

| Chip-enabled | X | X |

| MasterCard World Elite Concierge & Luxury Travel Benefits | X | X |

| 1st free checked bag for you and travel companions | X (up to 8 traveling companions) | X (up to 4 traveling companions) |

| 10% back on redeemed miles (up to 10,000 miles per year) | X | X |

| Priority boarding | X | X |

| 25% discount on food, beverages, headsets purchased in-flight | X | X |

| No foreign transaction fees | X |

Last Call for US Airways Card?

Link: 40,000 US Airways card

Link: My Review of the US Airways card

If you don’t already have the US Airways card, this may be your last chance. And as I’ve speculated, you won’t be able to apply for a Barclaycard AAdvantage Aviator Silver or AAdvantage Aviator Red card because they will only be issued to existing US Airways cardholders.

Some folks have received targeted offers for 50,000 US Airways miles.

If you weren’t targeted, you can get 40,000 US Airways miles after your 1st purchase and payment of the $89 annual fee. And you get an additional 10,000 US Airways miles on your 1st card anniversary!

Note: This is NOT my link. That’s because my link doesn’t include the 10,000 US Airways anniversary miles. And I always want you to know about the best offer, even if it doesn’t earn me a commission!Bottom Line

Existing US Airways cardholders will be converted to the AAdvantage Aviator Red cards, but some folks are being offered the option to upgrade to the AAdvantage Aviator Silver card. You have to upgrade by December 1, 2014.

The AAdvantage Aviator Silver card comes with a $195 annual fee (NOT waived the 1st year) and no foreign transaction fees. This would be a good card for folks who are Big Spenders, buy a lot of airline tickets, and have elite status with American Airlines.

For most folks, the AAdvantage Aviator Red card with the $89 annual fee (NOT waived the 1st year) is cheaper.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!