2 Cards That Allow You to Choose Your Bonus Categories

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Most rewards credit cards either have set categories where you can earn bonus points or they have rotating categories.

But there are 2 cash back cards that allow you to choose where you’d like to save the most money. They are the AMEX SimplyCash and US Bank Cash+.

Choosing Categories With AMEX SimplyCash

Link: AMEX SimplyCash

Link: AMEX SimplyCash Review

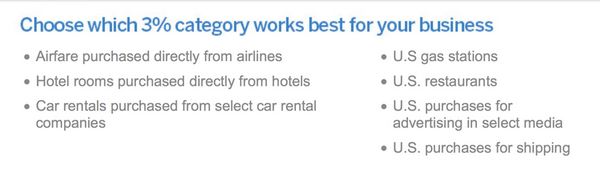

Along with the $250 sign-up bonus you get with AMEX SimplyCash card (if you apply by September 21, 2015 January 25, 2016 April 27, 2016), you also get 5% cash back at US office supply stores and US cell service. Plus you can earn 3% cash back on up to $25,000 of spending per year in a category of your choice.

Be sure to read the restrictions before you select a category!

You have 2 months after signing-up for the card to pick a category online or by calling the number on the back of your card. Don’t worry if you have trouble deciding! Your cash back category will apply retroactively to any qualifying purchases you’ve made since you received your card.

However, if you don’t make a selection after 2 months, you will automatically receive 3% cash back at US gas stations.

After your first 2 months, you will only be able to change your cash back category once a year.

Choosing Categories With US Bank Cash+

Link: US Bank Cash+ (This card is only available in-branch)

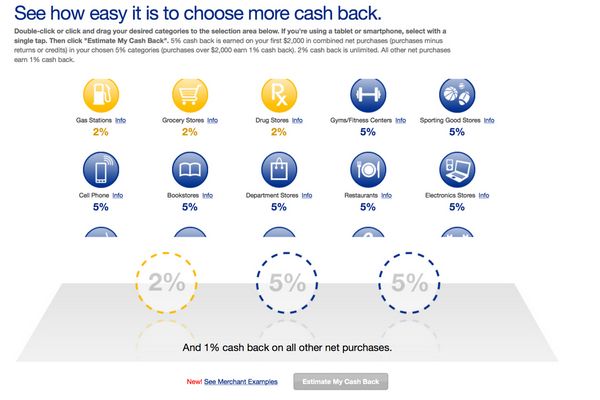

With the US Bank Cash+ card, you earn 5% cash back on $2,000 worth of spending in 2 categories of your choice. You’ll also get an unlimited 2% cash back on 1 category of your choice.

There are 15 categories to choose from:

- Bookstores

- Car Rental

- Cell Phone

- Charity

- Department Stores

- Drug Stores

- Electronics Stores

- Fast Food

- Furniture Stores

- Gas Stations

- Grocery Stores

- Gyms

- Movie Theaters

- Restaurants

- Sporting Good Stores

Get more details on each category before you make a decision!

Lock-in your categories online or by calling the number on the back of your card.

If you don’t choose your categories for the quarter, you will only earn 1% cash back on all purchases.

Bottom Line

The American Express SimplyCash and US Bank Cash+ cards both give you the freedom of choice! Which categories you earn cash back in is up to you.

With the AMEX SimplyCash card, you will earn 3% cash back in 1 category of your choice. While the US Bank Cash+ card lets you choose two 5% cash back categories and one 2% cash back category.

Do you know of any other cards that allow you to choose your categories?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!