Is Xoom International Money Transfer a Good Way to Earn Miles and Points?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Did you know you can transfer money overseas with Xoom money transfer using a credit card?

Xoom promotes itself as a safe, quick and easy method to send money to friends and family abroad. And you can use your bank account, debit card, or credit card as a source of funds.

But is this a good method to earn miles and points or meet minimum spending requirements? I decided to find out!

I used credit cards from Chase, Barclaycard, and Citi (Xoom does NOT take American Express). The results were disappointing. You’ll be charged cash advance fees!

What’s Xoom?

Link: Xoom Money Transfer

Xoom is an online money transfer company that allows you to send money to others directly from your desktop or mobile device. They advertise low fees, good exchange rates, and secure transactions which you can track via email or mobile phone.

You can send money to 30 countries by direct transfer to the recipient’s bank. While not all banks in each country are available, they seem to have many of the major banks on their list.

Here are the countries you can transfer money to with Xoom:

- Argentina

- Australia

- Bolivia

- Brazil

- Canada

- Chile

- Colombia

- Costa Rica

- Dominican Republic

- Ecuador

- El Salvador

- France

- Germany

- Guatemala

- Honduras

- India

- Ireland

- Italy

- Jamaica

- Mexico

- Netherlands

- Nicaragua

- Panama

- Peru

- Philippines

- Poland

- Spain

- United Kingdom

- Uruguay

- Vietnam

How Does It Work?

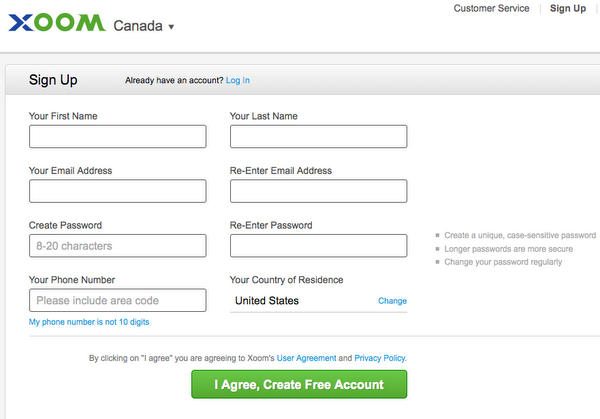

1. Sign-Up for a Free Xoom Account

Link: Sign-Up for Xoom

Before you send money with Xoom, you need to sign-up for an account. Initially, you’ll enter your name, email address, phone number, and a password.

You won’t need to add your address or phone number until you actually make a money transfer.

2. Select Country and Amount to Send

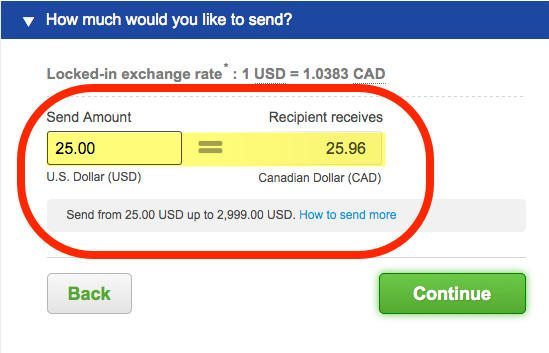

Once you have an account, you can select the country you’d like to send money to. I enlisted the help of a friend in Canada to do my money transfer experiment. The minimum amount you can send is $25, and the maximum is $2,999. You’re also limited to:

- $2,999 in 24 hours

- $6,000 in 30 days

- $9,999 in 180 days

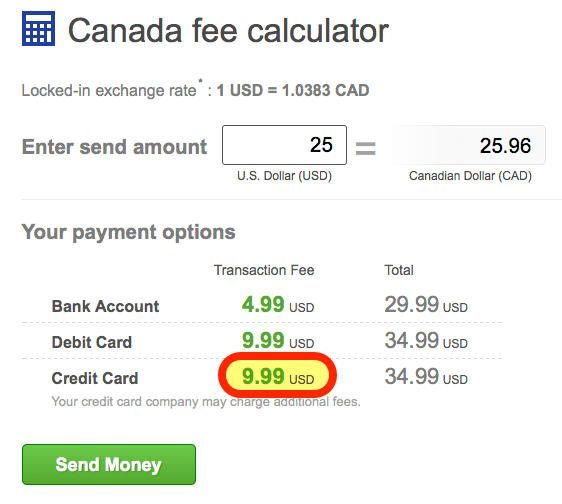

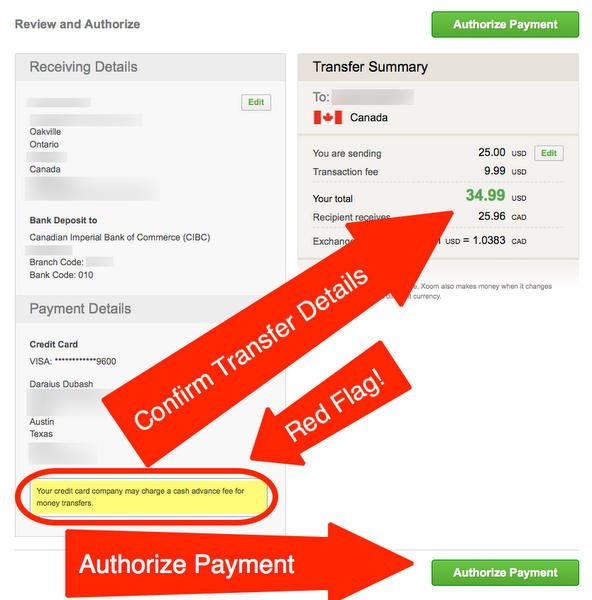

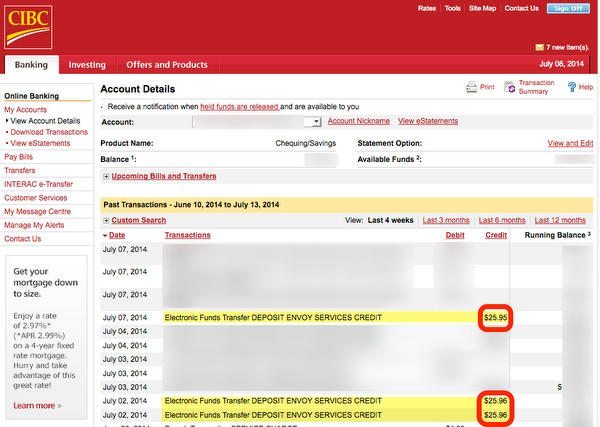

You’ll be asked how much you’d like to send. They’ll also let you know what the exchange rate is. In this case, $25 US = 25.96 Canadian dollars.

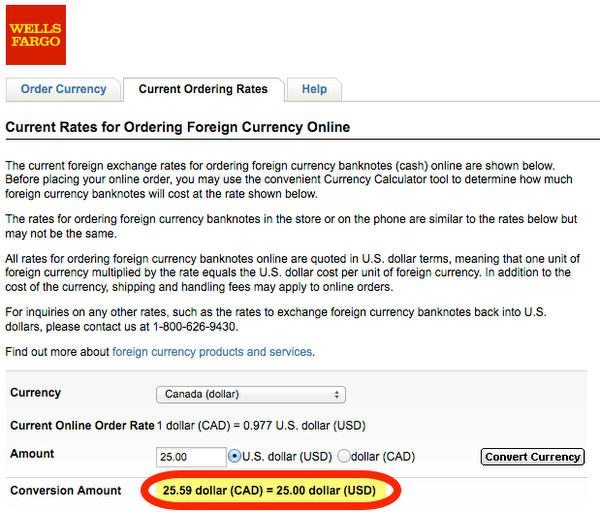

To compare, I checked the currency conversion calculator for Wells Fargo bank to see if there was much difference. Wells Fargo’s rate was actually slightly worse. I’d get 25.59 Canadian dollars for $25.

Out of curiosity, I checked a Canadian bank (RBC) and their rate was also a little worse than Xoom. They’d give 25.78 Canadian dollars for $25.

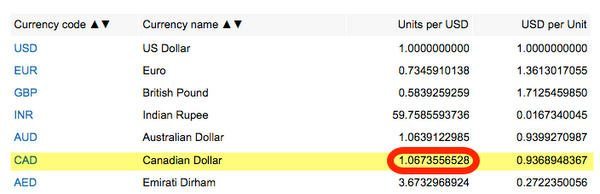

To compare, I checked the interbank exchange rate for the same day on xe.com and $1 was worth 1.0673 Canadian dollars. So $25 would get you ~$26.68. Keep in mind that consumers don’t usually get this good a rate!

Now, I can’t guarantee that Xoom’s rates are good for all countries, but for Canada the rate is competitive.

3. Select Your Method of Payment

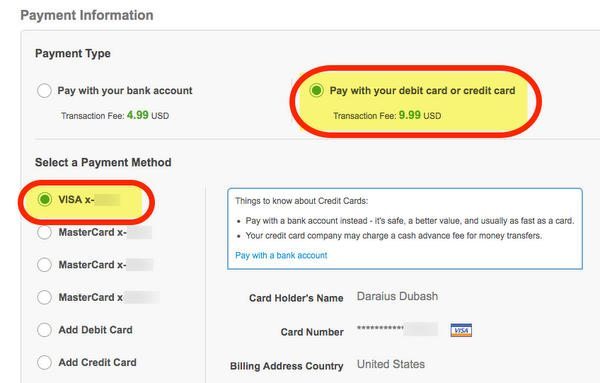

You can choose to send money from your bank account, debit card, or credit card. Xoom charges a fee depending on the transaction amount and method of payment. The fee for sending from your bank account is always ~$5. But for debit and credit card transactions, the fee goes up the more money you send.

For my small transaction of $25, the fee to use a credit card was ~$10.

The highest fee you’ll pay (if you send the maximum amount of $2,999) is ~$40. But I don’t like my friend that much! 😉

4. Enter Recipient’s Banking Information

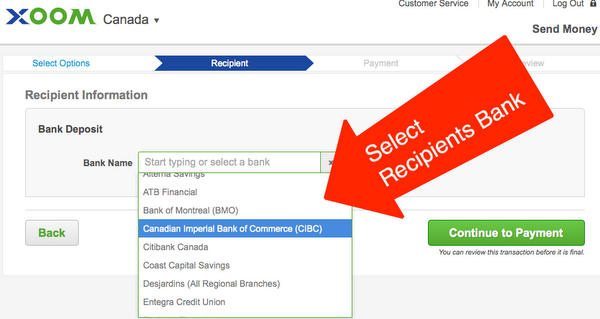

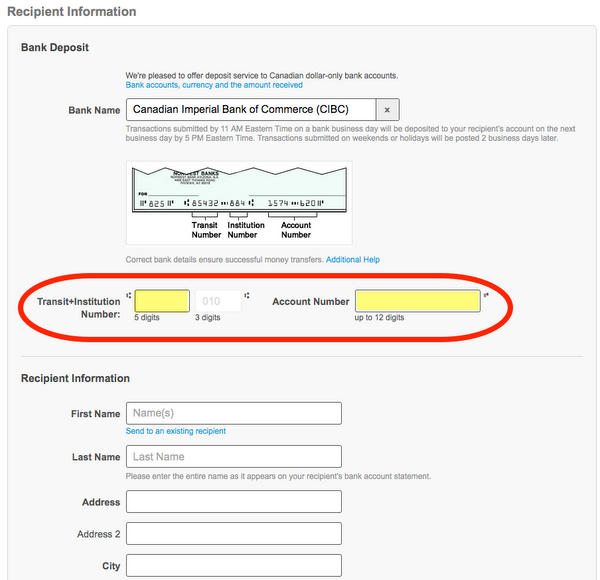

You’ll need your friend’s name, address, bank name, transit number, institution number, and account number. For other countries, the information required may be different.

First select the bank.

The recipient can give you the transit number and account number from 1 of their checks. The institution number automatically fills in based on the bank you’ve chosen. You’ll also need your friend’s name, address, phone number, and email address.

5. Enter Your Payment Information

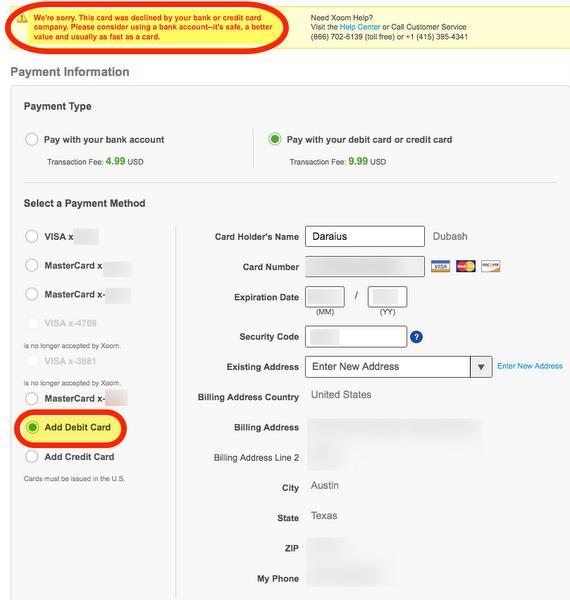

If you’re using a credit or debit card, you can choose 1 you’ve previously used for other transfers. Or you can add a new debit or credit card. You’ll have to add your billing address and phone number, too.

You’ll have 1 last chance to review the transaction before you hit “Authorize Payment.” There’s a warning that you may be charged a cash advance fee from the credit card company, but I wanted to see for myself!

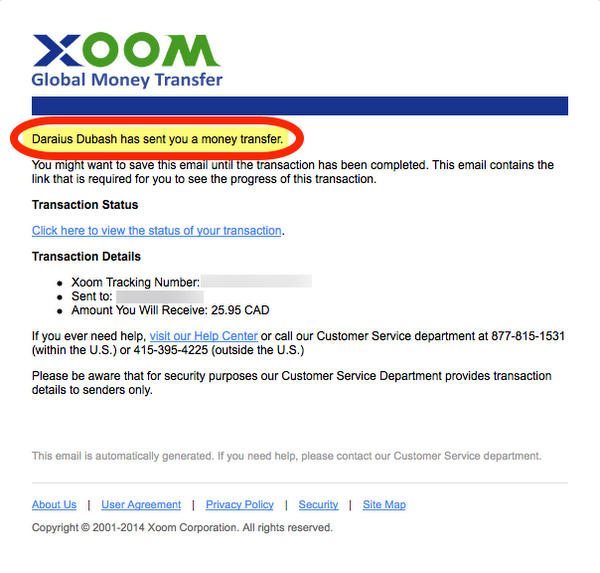

6. Monitor the Transaction via Email

Both you and the recipient will receive emails indicating that a transfer has been initiated. It takes 2 to 3 business days for the money to arrive in the recipient’s account. Other countries may have longer wait times.

After ~3 days, the money was in my friend’s account. I sent 3 separate transactions using a Chase, Barclaycard, and Citi credit card. My friend did not get charged incoming wire transfer fees that are often charged on bank-to-bank transfers.

So Xoom is definitely easy to use, if you don’t mind paying the fees. But would my purchases count as cash advances? Would they earn miles and points and count towards minimum spending requirements?

The Results Are In

And it’s NOT good news!

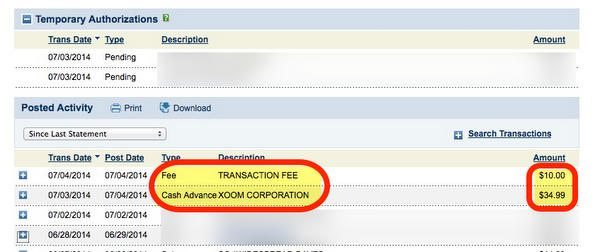

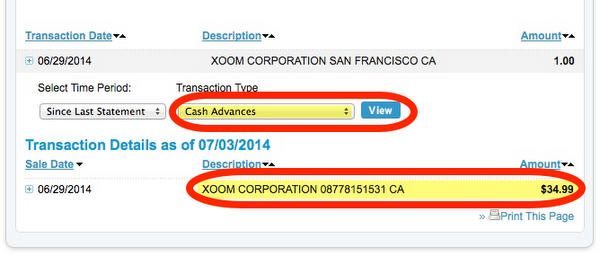

All 3 banks I tried (Chase, Barclaycard, and Citi) treated these transactions as a cash advance! Cash advances can NOT be used to meet credit card minimum spending requirements.

Chase charged me a $10 cash advance fee. I didn’t earn points for the purchase.

Barclaycard also charged a $10 cash advance fee. I didn’t earn miles for the purchase, either.

And Citi also treated it as a cash advance with no miles earned.

So while Xoom may be an easy way to send money to friends and family, you will NOT earn miles and points for the transaction (with Chase, Barclaycard, and Citi anyway), and will incur cash advance fees. And you can NOT count cash advances towards meeting minimum spending requirements for most credit cards.

That said, I haven’t experimented with other banks. It’s possible there are credit cards that can be used that count as a purchase and not a cash advance.

What About Gift Cards?

Undeterred, I tried sending my friend money using a Vanilla Visa gift card I bought with a miles-and-points earning credit card.

I got denied even before I got to the “Review Payment” screen!

That said, I haven’t tried every brand of gift card. If you’ve found 1 that works, please let me know in the comments!

Bottom Line

Xoom is a good way to transfer money to friends and family overseas. Their rates seem competitive, and transfers take ~3 days. You’ll pay fees depending on method of payment and amount sent.But it is NOT a method to earn miles and points or meet minimum spending requirements. All 3 credit cards I tried (Chase, Barclaycard, and Citi) posted the transaction as a cash advance, which means NO miles and points, a cash advance fee, and NO credit toward minimum spending.

I have NOT tried other banks, so don’t know if this is true for all credit cards!

Have you found a credit card that works with Xoom without posting as a cash advance? Or a debit gift card that can be used? Please let me know in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!