Emily’s 4 Cards. 140,000 Miles, 60,000 Points + $600 in Statement Credits!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Emily & I have been thinking of getting our 1st house, so we haven’t applied for many credit cards in the past year. I applied for 3 cards at the end of January for 100,000 miles and $890 in statement credits and Emily decided if I could apply for new cards, she could too! So she recently applied for 4 cards.

Read This Before Applying!

Your credit score usually decreases by 3 to 8 points per credit card application temporarily. However, your score shouldI do NOT recommend applying for credit cards if you plan on taking out a major loan within the next 1 to 2 years.

We pay our credit cards off every month. Carrying a balance on your card and paying interest usually isn’t worth the miles and points you’ll get if paying interest charges.

Please read the 5 Dangers of Credit Cards before applying for a card.

If you’re applying for a big loan, you should wait until you get your loan. You should do everything possible to get a low interest rate on the big loan first, and then apply for credit cards. You also shouldn’t apply for many cards in the 2 years before a mortgage or refinance.

Set Travel Goals

Emily and I set travel goals and then collect miles and points to reach those goals. We want to have enough miles and points to travel coach within the US to visit friends, to visit family in Michigan and Ohio, and to have weekend getaways.

We also want to travel internationally 2 to 3 times a year – in Business or First Class, but we’ll fly in coach if it means less connections and more time at our destination.

We also need hotel points because we have to stay somewhere. We don’t really care which airline we fly or hotel we stay in as long as we can save money while traveling.

Having mile and points with different airlines, hotels and cash back cards gives us lots of options when we book our trips!

Credit Card Resources

Here are a few resources which list the best miles and points deals and tips on meeting the minimum spending.

- Hot Deals tab lists my favorite cards with a large sign-up bonus or great perks

- 40+ Powerful Ways To Complete Your Credit Card Minimum Spending Requirements so you can get the sign-up bonus

- Paying bills such as my rent, car loans, and student loans

4 Cards From 4 Different Banks

Every 3 to 4 months, we usually apply for credit cards from different banks, so we don’t have credit inquiries (which usually happens every time you apply for credit) hitting only 1 credit bureau.

I limit the number of inquiries on each of the credit bureaus because banks don’t like seeing too many inquiries (especially in the last 6 to 12 months) on your credit report. However, applying for 1 or 2 cards at a time shouldn’t have much impact.

The 3 main credit bureaus in the US are Equifax, Experian, and TransUnion. Banks usually request your credit report from 1 (or more) of these credit bureaus. The exact credit bureau used depends on where you live and which bank you’ve applied for credit from.

1. Barclaycard US Airways

Link: Barclaycard US Airways Card

Link: My Review of the Barclaycard US Airways Card

Emily applied for the US Airways card 1st because Barclaycard doesn’t like a lot of credit inquiries on your credit report. If you already have a Barclaycard such as the Barclaycard Arrival Plus® World Elite Mastercard®, they like to see you using it.

Emily wanted to get the Barclaycard US Airways card because you get 40,000 miles after your 1st purchase and paying the $89 annual fee. These miles will eventually become American Airline miles which we use for international travel.

She got instantly approved for the card with a very generous $15,000 credit limit!

2. Chase Ink Bold

Update: The Chase Ink Bold card is no longer available for new sign-ups.Link: Chase Ink Bold Card

Link: My Review of the Chase Ink Bold Card

Emily had the earlier MasterCard version of the Chase Ink Bold card which she had closed earlier. That’s because she preferred using the Chase Ink Plus for all her business expenses.

However, the Chase Ink Bold is now issued as a Visa card. So she applied again to get the 60,000 Chase Ultimate Rewards point sign-up bonus, the no set spending limit, and the Visa benefits. The Visa versions get you additional discounts in the Visa Savings Edge program.

We love the Chase Ink Bold & Chase Ink Plus cards because:

- You earn 5X points on cable/internet/telecom purchases and at office supply stores

- You earn 2X points on gas & hotel purchases

- There are NO foreign transaction fees

- Points never expire and can be transferred to United Airlines, Virgin Atlantic, British Airways, Hyatt, Marriott, Priority Club,Ritz-Carlton, Korean Air, Singapore Airlines, Southwest, and Amtrak

- The Chase Ink Plus is a credit card while the Chase Ink Bold is a charge card. You have to pay the balance on your Chase Ink Bold in full (which you should always do), but can carry a balance on the Chase Ink Plus (not recommended because of the high interest fees)

We’ve used Chase Ultimate Rewards points to have lots of Big Travel with Small Money to Paris, Maui, Italy, Kauai, and Switzerland.

She was not instantly approved for the Chase Ink Bold. We’ll wait this one out, because Chase is very busy processing applications because the 60,000 point offer ends on June 1, 2014!

3. Citi American Airlines Executive Card

Link: Citi AAdvantage Executive World Elite Mastercard

Link: My Review of the American Airlines Executive Card

You earn 100,000 American Airlines miles and a $200 statement credit after spending $10,000 within 3 months.

This card has a $450 annual fee, but you get a $200 statement credit after spending $200 or more on the card. So you’re effectively paying $250 for 100,000 American Airlines miles and American Airlines lounge membership.

This is one of the best deals which I’ve seen in the last year.

We love American Airline miles because they’re easy to use for domestic US travel and for First Class international travel. Here’s my series on how to redeem your American Airlines miles.

You also get 1 free checked bag and priority check-in and boarding with the card. You can apply for the Citi Executive card even if you already have another Citi American Airlines card. But you should wait ~8 days between personal Citi applications and don’t apply for more than 2 cards within ~65 days.

Emily had to call 800-695-5171 to get approved for the card. The representative asked a few questions then transferred credit from an existing Citi card and she was approved!

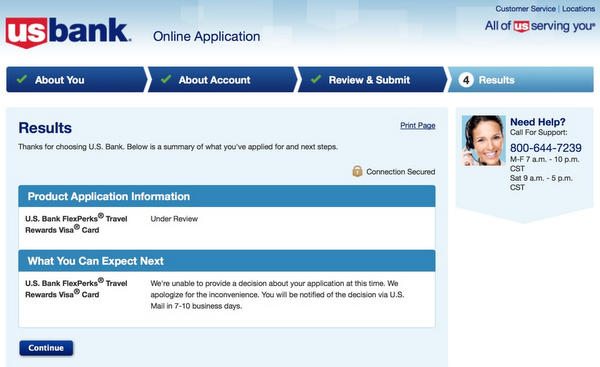

4. US Bank FlexPerks Travel Rewards

Link: US Bank FlexPerks Travel Rewards Card

Link: My Review of the US Bank FlexPerks Travel Rewards Card

This card isn’t from Chase, American Express, or Citi, so Emily didn’t have to worry about maxing out applications from those banks.

Emily applied for the US Bank FlexPerks card to get points to redeem easily with no restrictions or blackout dates, which is great for tickets within the US, especially if you don’t have the Southwest Companion Pass. You will also earn elite qualifying miles on the ticket, which may be important to some folks (not us!).

You also get 3X points on charitable donations which will come in handy when Emily makes donations to Casa de Orientación y Desarrollo Real (CODR).

Emily can choose to earn 2X points on gas, groceries or air travel. We’ll likely choose groceries because you can often buy gift cards in grocery stores.

She was not instantly approved for the US Bank Flexperks Travel Rewards card. US Bank takes their own time to approve applications, so we’ll wait this out. We’ve both frozen our IDA and ARS reports, because there are lots of reports of inaccuracies on those reports.

Bottom Line

Many of the millions of miles which Emily and I use for Big Travel with Small Money have come from credit card sign-up bonuses.

We use our miles and points to fly domestically and internationally and spend time with friends and family. The minimum spending may seem high, but there are lots of ways to meet the minimum spending requirement creatively!

This is a great way to earn lots of miles and points, but you HAVE to be careful.

Don’t apply for credit cards if you can’t pay off the entire balance monthly. And don’t apply for credit cards if you will be applying for a big loan in the next 1 to 2 years.Before you apply for a credit card, you should read The 5 Dangers of Credit Cards.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!