Why 35,000 US Air Miles Could be Better Than 40,000 US Air Miles

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: This offer is no longer available. Check our Hot Deals for the latest offers. Thanks to Million Mile Secrets reader Abhi for commenting that you can get 40,000 miles from the Barclaycard US Air card after your 1st purchase.The advertisement says “up to 50,000” miles, but you really get only 40,000 miles after your 1st purchase. You get the remaining 10,000 miles after a balance transfer (when you transfer a balance from one credit card to another credit). The balance transfer is NOT worth the cash advance interest rate and other fees charged for balance transfers.

US Airways Card

Link: 40,000 Miles Airways Card

You can get 40,000 miles from the US Airways card, but the $89 annual fee is NOT waived.Remember that US Air miles will soon be American Airlines miles.

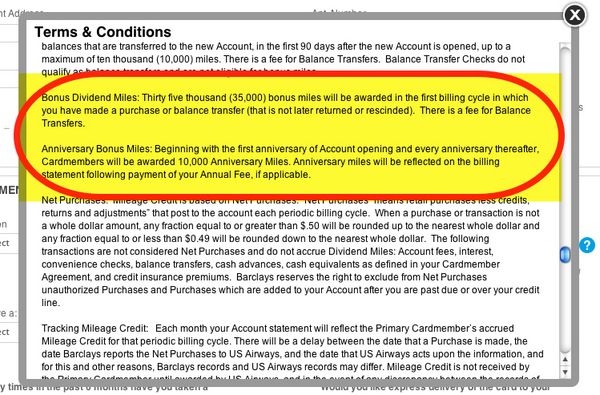

This is a better offer than the link which pays me a commission (click the link to compare offers, but do NOT apply for this version), but which offers you only 30,000 miles. However, you can get a potentially better offer.The best current offer is for 35,000 US Air miles after your 1st purchase with no annual fee for the first year. You also get 10,000 miles on each anniversary, but Barclaycard might not issue this card in one year!

Which Offer is Better?

You can either get 35,000 US Air miles with no annual fee. Or 40,000 US Air miles with an $89 annual fee.

This means that you’re paying $89 for the extra 5,000 miles which you get for the 40,000 mile offer. So you’re effectively paying ~1.8 cents per US Air mile ($89 annual fee / 5,000 extra US Air miles)If you don’t mind paying 1.8 cents per US Air mile, go for the 40,000 mile offer. Otherwise, the 35,000 mile offer is better!

Using US Air Miles

US Air is currently (until March 30, 2014), part of the Star Alliance which has pretty good award availability to Europe and Asia.But you have to book your award seats by March 30, 2014 before US Air leaves the Star Alliance. You can book travel ~330 days out.

You could fly to Asia with a stopover in Europe for only 60,000 miles in coach, 90,000 miles in Business Class, and 120,000 miles in First Class.

Bottom Line

You can get 40,000 miles from the Barclaycard US Air card which is better than my 30,000 mile affiliate link. But the annual fee is not waived.

That’s why the 35,000 mile offer with the annual fee waived could be better for some.

You can book awards on Star Alliance airlines up to March 30, 2014 with US Air miles. You can also use US Air miles to book award tickets on American Airlines flights.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!