Does Lowering Your Credit Limit Help You Get Approved For More Credit Cards?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Does Lowering Your Credit Limit Help You Get Approved For More Credit Cards?

Million Mile Secrets reader Leighton commented:Does a request to lower a credit card limit improve your chances for being approved for another credit card with the same bank, and will it afffect your credit score?

Leighton wants to know if reducing his credit limit on a credit card will help him get approved for a second credit card from the same bank.

Lowering Your Credit Limit

Let’s say that Leighton has a Chase Sapphire Preferred card and wants to apply for the Chase Freedom because of the signup bonus. But he’s not sure he will get approved for a second card from Chase. So should he lower his credit limit on the Chase Sapphire Preferred?

Leighton could reduce his line of credit on his Chase Sapphire Preferred card, by calling the number at the back of his card, especially if he’s close to the maximum amount of credit which the bank will extend to him.

Most banks set a limit on the TOTAL credit amount which they will extend to you. This limit is based on the bank’s internal risk-taking (or underwriting) policy, your income, length of credit history, and other variables on your credit report.

You may reach this total limit with 2, 3, or 4 or more credit cards, depending on the credit limit assigned to each credit card.

Once you reach this limit, banks will no longer extend you any new credit because doing so will increase the bank’s risk exposure.

So it is reasonable to think that lowering your credit line in advance could help you get approved for a new card.

But reducing your credit line may not be the best option and could actually decrease your credit score if you have few credit cards.

Transferring Your Credit Limit

Instead of lowering his line of credit on his Chase Sapphire Preferred in advance, Leighton could just apply for the Chase Freedom card.

He can then call and ask to transfer credit from his Chase Sapphire Preferred card to his Chase Freedom card.

That way he gets to keep his total credit line and get approved for a new card.What Is A Credit Score?

A credit score is a 3-digit score used by banks to help predict if Leighton will pay back loans. Fair Issac Corporation (FICO) issues FICO scores ranging from 300 to 850.

There are 3 main credit bureaus in the US – Equifax, TransUnion & Experian – and Leighton will have 1 credit score from each bureau.

How Is Your Credit Score Calculated?

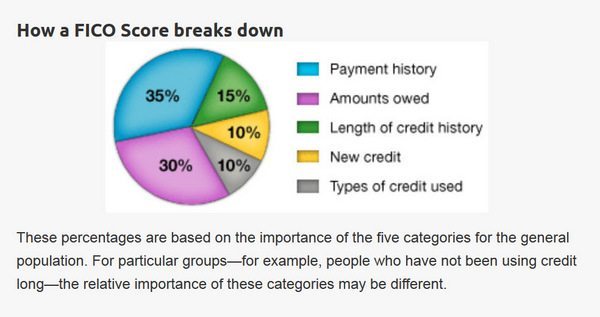

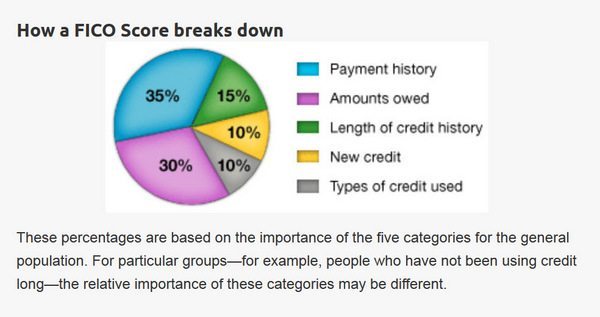

According to the FICO website, Leighton’s credit score is determined by:

- 35% Payment History — (Do you pay on time?)

- 30% Amounts Owed – (Do you use a lot or little credit?)

- 15% Length of Credit History — (How long have you had credit?)

- 10% New Credit — (Have you applied for credit recently?)

- 10% Types of Credit — (Do you have different credit types?)

Leighton’s Payment History is the most important factor in determining his credit score.

The second most important factor are the Amounts Owed. Having debt doesn’t necessarily mean that Leighton is a high-risk borrower.

But if Leighton uses a lot of his available credit (has a high credit utilization ratio), the banks get nervous and think Leighton may not be able to pay his bills. So it’s important that Leighton doesn’t max out his credit card and keeps a low utilization ratio.

Reducing Your Credit Line Could Lower Your Credit Score

If Leighton lowers his available credit it could decrease his credit score because it increases his utilization ratio.

For example, let’s say Leighton has a $10,000 credit limit on his Chase Sapphire Preferred with a reported balance of $1,000. This means that his utilization ratio is 10% ($1,000 reported balance ÷ $10,000 total credit line).

If Leighton reduces his credit limit to $5,000 before he applies for the Chase Freedom, his utilization ratio increases to 20% ($1,000 reported balance ÷ $5,000 total credit line).

So lowering his credit limit on his only card could cause Leighton’s credit score to drop significantly.

If someone is using more of their available credit, it could be a sign that the person is hard-up and needs to use credit to make ends meet.

This credit score decrease is most likely to happen if Leighton has one or few cards.

If Leighton Has Lots of Cards

On the other hand, decreasing his credit line by $5,000 will likely have a very, very, small impact on his credit score if Leighton has 15 open credit cards!

So if he doesn’t want to call and trade credit lines, Leighton could reduce the credit line on one of his cards, and then apply for a different card from the same bank.

But Leighton shouldn’t do this unless he has a lot of open credit cards and outstanding credit available.

Note that some banks don’t usually let your transfer credit from 1 card to another card.

Bottom Line

Lowering his credit limit on a credit card from one bank could help Leighton get approved for more credit cards from that same bank.

But it could also lower Leighton’s credit score, especially if he has very few credit cards.

A better approach could be to apply for the second card and move credit from his existing card to the new card.

That said, I use a mixture of both methods. Sometimes I will just cancel a card without transferring the credit line and get approved for a new card. And sometimes I will try to trade credit from one card to another cards.

That’s because I have over 15 open credit cards and a high amount of available credit, so losing a little bit of my credit line when I cancel doesn’t really impact my credit score.

But everyone’s situation is different. So do what’s comfortable for you!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!